When Do Private B2B SaaS Companies Raise Equity?

December 11, 2020

In our 9th annual survey* of private B2B SaaS companies, we asked participants questions to explore the overall topic of capital efficiency. This is the first of a four-part series examining the data and focuses on when private SaaS companies raise equity.

According to our survey, twenty-four percent of companies never raise equity at all, and another twenty-three percent primarily raise equity only from angel investors. Thirty-one percent of companies raise the majority of funds from traditional venture capitalists, while fifteen percent are private equity funded, and five percent are primarily funded by strategic investors.

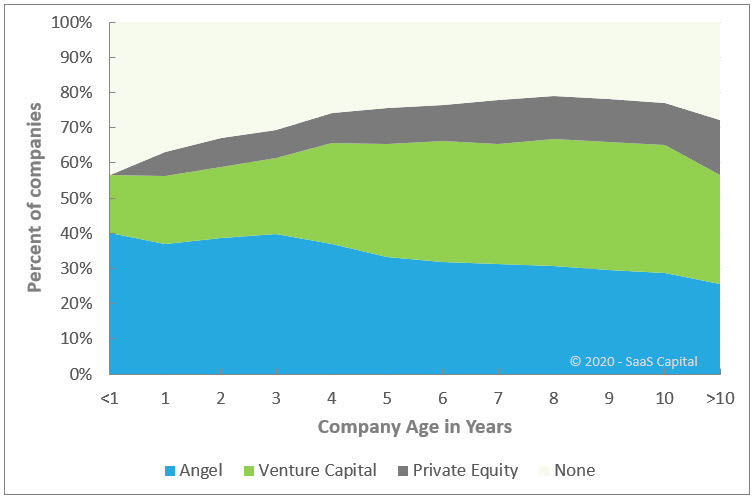

In terms of timing, the chart above shows that 40% of companies are bootstrapped at founding, and another 40% start with angel backing. Venture funding really begins to proliferate about the time that SaaS companies turn four years old. The percent of companies backed by VCs grows from 21% in year 3 to 32% in year 5.

From the survey data we have found that the average time to get to $1 million in ARR is about 4 to 6 years. Combining these data points, it appears that the run rate revenue threshold to attract institutional equity investors is about $1 million in ARR.

The percent of companies using outside capital peaks at about year eight, with 79% of all companies. Very interestingly, starting about then, the percent of companies that primarily financed through angel investors and VCs begins to decline. The percent of companies that primarily use PE dollars or bootstrapped expands.

Our hypothesis is that it is at this point – years 8, 9, or 10 – when early-stage equity investors begin seeking an exit for their portfolio companies in order to return liquidity to their limited partners. There are simply fewer companies of this age now, and more of the remaining companies are still bootstrapped.

The last comment on the chart above is that, despite what has seemed like a gold rush of private equity interest into the SaaS industry over the last several years, only 12% of companies in the survey report primarily being funded from that source.

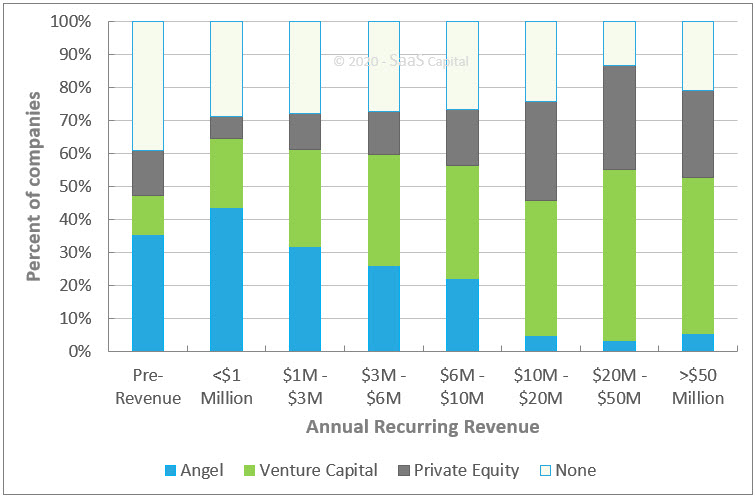

The chart above examines the same data by revenue level, instead of by company age. The hypothesis that VCs get more heavily involved post-$1 million in ARR is supported in this chart, as we see the percent of companies funded by VC expand significantly at the $1 million ARR mark.

Up to $10 million in ARR, approximately 25% of companies are bootstrapped. Above $10 million ARR is where private equity becomes a significant source of funding. This is consistent with SaaS Capital’s anecdotal experience.

For more research around capital formation and the capital efficiency of SaaS companies, please see – Private SaaS Company Funding, Runway, and Capital Efficiency Benchmarking

*In the first quarter of each year, SaaS Capital conducts a survey of B2B SaaS company metrics. This year’s study marked our 9th annual survey, and, with over 1,400 private B2B SaaS companies responding this year, it is the largest survey of its kind and continues to grow every year. This year, for the first time, we asked several questions on funding sources and amounts and cash balances to study capital efficiency and runway among private SaaS companies.

It also needs to be explicitly stated that this data was collected in early 2020 and is based on 2019 performance metrics and data, before the impact of the COVID-19 pandemic. Benchmarking comparisons should be made to the same time period for your company.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe