Alternative Financing Methods for SaaS Companies

February 15, 2022

SaaS Capital began funding software companies in 2007, at a time when banks were highly reluctant to offer meaningful lines of credit, and the so-called “venture debt” industry focused solely on companies that already raised venture capital. Since that time, a thriving ecosystem of SaaS-oriented capital providers has entered the fray.

Some, like SaaS Capital, are best thought of as specialty lenders, because we primarily offer an adapted version of a well-known, standard structure (line of credit) that we’ve found well suited specifically to growing private SaaS companies. Other options in this ecosystem, however, work differently or use non-standard approaches. This post attempts to explore those alternative financing methods and when they might be a good fit (versus a line of credit or loan from a specialty lender like SaaS Capital). But first, a word on the main concept behind the financing of SaaS companies.

SaaS Entrepreneurs Can Often “Outgrow” Their Repayment Period

The reason why SaaS founders would choose to take any kind of “debt-like” capital — that is, capital that must be repaid prior to exit — is because they expect to grow faster than the money must be repaid. Because SaaS businesses are valued on a multiple of recurring revenue (ARR), the ability to increase that revenue figure by, say, $1 million could be worth $5 million or more in equity value to the founders.

This must ultimately be balanced, though, by the fact that private SaaS companies typically operate at a loss and have a finite “runway” before they’re out of cash. Since debt or debt-like financing must be repaid, typically in a shorter timeframe than the anticipated exit, it really only works when the increased growth, in both revenue and in eventual cash flow, outpaces the requirement for repayment.

In a simplified way, you can think of this as meaning that your “payback” on investing in new customers (Customer Acquisition Cost Payback Period, or CAC Payback) must be shorter than the repayment period of the financing:

(Customer Acquisition Cost / (Customer MRR * Gross Margin %) ) < Repayment Period

This formula is, of course, an oversimplified illustration, but generally speaking, it is a good sanity check: you must be able to use any new financing to grow before you have to repay it. (A profitable business might afford the luxury of making a bad choice about repayment periods, but not a breakeven or cash-burning startup!)

What is “Subscription Advance Funding” for SaaS?

Subscription Advance Funding is similar to, but not quite the same as, factoring, which gives businesses immediate capital based on the future income attributed to a specific account receivable or a business invoice. Factoring traces its roots back to the 1300s as a product of the wool industry1 and as a result, is sort of built for funding against a one-time order of goods that’s already been sold. Subscription Advance Funding can also be thought of as similar to, but again, not quite the same as, a merchant cash advance, which gained traction in brick-and-mortar businesses where revenue was primarily from credit and debit card sales. A merchant cash advance is based on a very short time horizon – usually a portion of next month’s credit card sales – and doesn’t anticipate any recurring or subscription component to revenue. Subscription advancing funding is new as of the early 2020s and is somewhere in the middle.

Being Up Front about Subscription Advance Funding

Recently, new-to-the-scene funders have been loudly promoting Subscription Advance Funding as “up front capital” and “upfront cash flow.” Funders, like Clearbanc, Pipe, and Capchase, claim to provide a set amount of funding extremely quickly and easily. For qualifying SaaS businesses, it’s true – but how does it work, and what’s the catch, if any?

Subscription advance funders are essentially fronting a full contract’s worth of subscription revenue at once – minus a fee. The funder then collects the subscription payments from the customer for the remainder of the contract term, while the borrower continues to provide the SaaS service. For companies that have long-term (at least 12 months) contracts, but bill and collect monthly, this type of advance can be suitable.

Furthermore, subscription advance funders are often able to act very quickly. In part, that’s because they’re taking credit risk on the customers, not on the borrower – the funder gets repaid by continuing to collect from the customers, which are typically limited to large, creditworthy enterprises. If your SaaS business sells to customers like Microsoft or the U.S. Government, it’s easy for the funder to have high confidence it will (eventually) get paid.

Another reason subscription advance funders (as of early 2022) can act quickly and charge relatively low rates is that they are themselves generally venture-backed, money-losing companies trying to grab market share. Their approach is intentionally unsustainable in the very long term, but as we have seen with companies like Uber, pursuing investor-subsidized penetration pricing schemes for over a decade now, there’s no telling how long it might last.

So, what, if anything, is the catch? The main issue is that the advance doesn’t actually give the borrower more cash to spend over the contract’s term – it just makes it available earlier. Imagine you have qualifying annual contracts totaling $100,000 per month, but you need a large sum of cash now. You could conceivably get as much as $1.1 million advanced to you (less a fee), which might meet your current need. However, you would forfeit the right to receive the $100,000 per month over the next year.

In effect, you’ve just turned smooth recurring revenue into lumpy feast-or-famine revenue. And it’s one-and-done – until you’ve gone out and signed up another $100k in MRR (or until you’ve fully repaid the advance), you can’t go do it again.

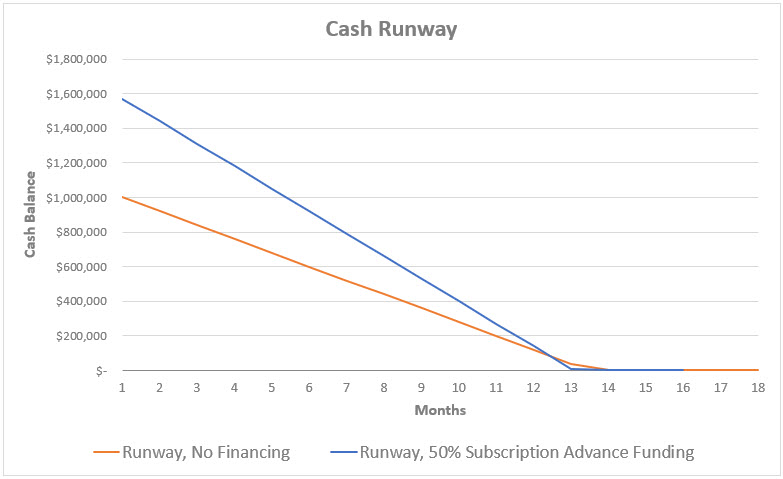

This graph shows what the effect would be on a typical company with $100k in MRR taking half of that as an advance with a 5% fee. (We say “typical” because it’s a company that would require more than 12 months to convert cash investment into customer gross profits – a greater than 12-month CAC Payback.) As you can see, the extra cash looks great in month 1 but doesn’t meaningfully extend the runway, unless that cash can be converted into not just extra customer contracts, but collected cash gross profit, prior to the end of the runway. Depending on the details of the fee and the use of funds, it could extend runway by a month or two – or it could even reduce it by a similar amount.

Of course, all forms of borrowing must be repaid over some period of time. But crucial to making the deal a win-win is that the use of the capital must allow the borrower to grow meaningfully faster before the capital is repaid. Remember our formula above, which requires that CAC Payback be faster than the repayment period? Doubtless, subscription advance funding helps some companies do this, but it’s not a universal fit. Even successful SaaS companies generally need more than a year to fully recoup investments in R&D, sales, onboarding, and collections. If, however, you have an extremely rapid cash conversion cycle, this type of advance may be a great fit.

The use case for subscription advance facilities is short-term bridge capital for growing companies with the key drivers being:

- Long contracts but short collections (e.g., annual contract / monthly billing)

- Creditworthy (large enterprise) customers

- Speed of funding crucial for near-term, fast-payback growth opportunity

Subscription Advance Facilities Advantages:

- Speed of funding

- Minimal covenants

- No venture capital or bank underwriting required

Subscription Advance Facilities Disadvantages:

- Inflexible, one-time advance of already-committed revenue

- Customers may be obligated to deal with the funder

- Only works well with extremely fast CAC Payback

What is Revenue-Based Financing (RBF)?

Revenue-Based Financing (also known as Royalty-Based Financing) typically gives a lump sum upfront and then asks for a fixed percentage of revenue as repayment. Everybody wants revenue to grow quickly, so there’s good alignment between borrower and financier. In fact, here at SaaS Capital, we’re very friendly with the idea of RBF: two of our partners helped launch the leading RBF company, Lighter Capital, and we often share referrals with Lighter and others, to help find the best fit for a borrower.

RBF: Spreading Repayment Over Time, or Time Over Repayments?

There’s another way to think about financing SaaS business growth that takes the opposite view: instead of thinking about a fixed repayment timeline, what if the repayment was somehow fixed as a portion of the revenue, however long that might take?

The flexible, revenue-linked nature of repayments in RBF is a “safety valve,” making it less likely that a borrower defaults if it hits a speed bump in its revenue (like losing a couple of big contracts). But it also leads to a tension: RBF is more attractive to a borrower the more volatile the revenue (and hence repayment); but it’s more attractive to the financier the less volatile the revenue. The borrower wants an equity-like partner; the financier wants a coupon bond.

The way to think about when RBF is healthy for a private SaaS company can seem complex, but it’s ultimately similar to the case with subscription advance: the royalty (repayment amount) must be a small enough proportion of the financing provided to allow the company time to realize its investment in new customer ARR. Since a healthy royalty rate generally must be under 10% (ideally under 5%) of ARR, there’s a limited amount of capital that a finance partner can extend. In all but the highest-growth companies, the financing amount is constrained, but generally speaking, is often around 20% of the ARR.

The real cost of RBF is difficult to know, and is driven by the multiple of the original advance that must be collected before the debt is fully repaid. The faster you repay the RBF, the higher the cost of capital.

In general, RBF, before any “sweetener” (like a warrant or success fee), will result in a cost of capital of anywhere from 22-25%. If the borrower has a growth rate above 4% per month, the cost of capital will exceed 30%.

Finally, an issue that can arise with RBF is what to do about future financing, particularly when a company has grown and demonstrated strong repayment, but needs more capital. The RBF financier can’t just add another lump sum in exchange for “another 5% (or 10%) on top” without quickly turning the company’s gross margins upside-down. Hence, the negotiation about subsequent capital availability can be fraught and relies heavily on trust and “good behavior” between the company and financier.

The use case for RBF facilities is medium-term growth capital for companies with the following characteristics:

- Somewhat predictable, but somewhat volatile revenue

- Strong gross margins and strong growth

- Relatively small amount of capital needed relative to ARR

RBF Style Facilities Advantages:

- Flexible repayments minimize the risk of financial distress

- Can provide medium-term (beyond one year) horizon

- No venture capital or bank underwriting required

RBF Style Facilities Disadvantages:

- Creates a direct, structural reduction in gross margin percentage

- Relatively high cost of capital

- Unclear path to extending or increasing facility

What are MRR-Based Credit Facilities?

SaaS Capital has been providing MRR-based credit facilities to growing private SaaS companies for over 14 years. In that time, we’ve discovered a “recipe” that tends to work well, balancing the needs of the borrower (for cash that can fund meaningful growth) with that of the lender (for a reasonable return relative to risk). Our facilities are committed capital, meaning that the borrower draws down the capital as needed over a two-year “draw period” during which there is no repayment of principal. Then, after the two-year draw period ends, the principal is repaid over a further three-year period.

One primary effect of this structure is that the repayment time is three to five years (average of four years). That means growing SaaS companies can make growth plans that take a year or more to fully convert into cash without worrying that repayment will require them to prematurely end their growth plans, or worse, shorten their runway.

An important secondary benefit of the SaaS Capital MRR-Based facility is that as MRR grows (the result of those growth plans starting to kick in), so does the availability, automatically. Since the line of credit availability is a multiple (generally 4x-8x) of MRR, and since the line is committed during the draw period, the borrower has the right – but not the obligation – to borrow that extra principal, if it’s needed and wanted.

The percentage cost for an MRR-Based credit facility from SaaS Capital will generally be significantly less than revenue-based financing or subscription advance funding; around the same as “venture debt” ([but see here] for more about the limits on who can get venture debt); and significantly more than bank debt (when and if bank credit is available). However, the overall dollar cost is usually lowest, regardless of percentage rate, when the borrower only takes what capital is needed, when it’s needed. That tends to work in favor of SaaS Capital borrowers, who have the flexibility to borrow from a committed facility across a long draw period. In contrast, venture debt and RBF generally require a borrower to take the entire loan (or a major part of it) at closing, often well before all that capital is required for growth – all while the interest (or “royalty”) clock is ticking.

MRR-Based Credit Facilities Example

A line of credit tied to a multiple of MRR, such as a SaaS Capital credit facility, provides both a longer-term horizon and a built-in mechanism for growing the financing along with the company’s growth. We describe in our Comparison Guide of Debt Options for SaaS Companies how this type of MRR-based credit facility is now relatively well-known and increasingly offered by tech-oriented lenders. At SaaS Capital, we are a specialty lender to private SaaS companies who typically won’t be offered these facilities by banks or “venture debt” lenders (who focus only on recently VC-funded companies).

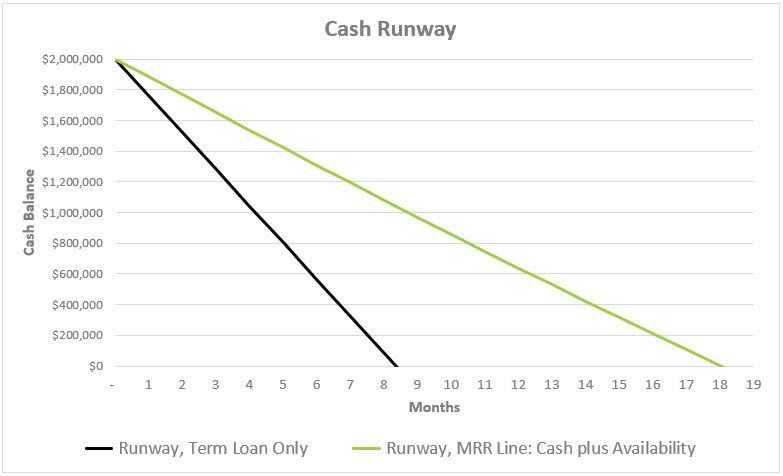

The example below shows a comparison between a straight term loan and an MRR-based credit facility. (It’s not a perfect comparison to either RBF or subscription advance – both of which are generally much smaller and, particularly in the case of subscription advance, repaid over a much shorter time horizon. That makes any direct comparison apples-to-oranges.) We show a term loan and an MRR-based facility each offering $2 million in initial cash availability. The term loan must be drawn down, all $2 million on day one. In the case of the MRR credit facility, however, the money is drawn down incrementally only as needed, which reduces the total dollar cost of interest.

Importantly, though, the cash runway, not the dollar (or percentage) interest cost is the crucially important matter for the ultimate value creation for entrepreneurs. This chart compares the “runway effect” of the term loan versus the MRR Line of Credit.

The major reason that the MRR Line wins here, to be frank, is that it is drawn over time and that as revenue (MRR) increases, so does the availability of capital, automatically and formulaically. And while most private SaaS companies have enough growth opportunity ahead of them that it makes more sense to finance continued aggressive growth, it’s even possible to use the increased availability to “outrun” the cash burn rate and to reach a self-sustaining “Goldilocks” scenario. Not too big, not too small, just right – a sort of perfect fit use case for an MRR Facility.

At SaaS Capital, our team has served over 150 borrowers, with a wide range from about $2 million to $40 million in ARR. We have had many, many borrowers increase their overall ARR by a factor of 2x to 5x without any incremental capital besides our MRR-based line of credit. Those entrepreneurs avoided typical equity round dilution of 10-30% per round, while increasing their value by 2x to 5x plus the size premium that typically attaches to SaaS businesses that pass “threshold” sizes like $5 million or $10 million in ARR.

The use case for MRR-based credit facilities is long-term (equity alternative) growth capital for steady growth, moderate burn companies with the key drivers being:

- Burn rate relative to MRR

- Growth rate of MRR

- Advance multiple on MRR

MRR-Based Credit Facilities Advantages:

- Interest expense efficient

- Greatest runway extension, can even be self-sustaining without requiring profitability

- Available to some non-venture-backed companies

MRR-Based Credit Facilities Disadvantages:

- Monthly reporting required

- Operating covenants are common (such as maintaining a minimum retention rate)

- Typically comes with some warrant coverage

Summary and SaaS Debt Resources

We encourage prospective borrowers to learn as much as possible about the options for private SaaS company financing. We are confident that our MRR-based facility solution will be highly attractive to companies for which it’s a great fit – and we likewise want to see borrowers who aren’t a great fit for us today, succeed and thrive with the right choice for them. For more about SaaS debt options, refer to our companion blog post on “venture debt for SaaS companies,” and also please see:

- Comparison Guide of Debt Options for SaaS Companies

- Appendix to Comparison Guide of Debt Options for SaaS Companies

- What’s Your SaaS Company Worth?

- Case Study: How ClearCompany Increased Their Valuation by Over $50 million

- Case Study: How Reeher Used Growth Debt to Position for an Acquisition

1 https://www.jstor.org/stable/1882892

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe