Weighting the Capital Efficiency of Private B2B SaaS Companies

February 26, 2021

In our 9th annual survey* of private B2B SaaS companies, we asked participants questions to explore the overall topic of capital efficiency. This is the fourth of a four-part series examining the data and focuses on capital efficiency.

Can We Weight a Company’s Performance by Its Capital Efficiency?

We wanted to investigate if there is a direct correlation between the amount of capital raised and company performance. The value proposition of raising outside capital is that it will help you grow faster than you otherwise could have, increase the value of your business in a shorter period of time, and ultimately, increase your wealth faster and/or more than otherwise possible. The cost is the dilution to a founding team’s ownership percentage from selling equity to an investor. The goal is that the value creation made with the extra cash outweighs the value lost through dilution.

Said another way, the venture capital sales pitch is that you will own a smaller piece of a much larger pie.

Without knowing far more detail around valuation, liquidation preferences, and participation rights, we can’t complete a company-by-company analysis, but below we propose a methodology for adjusting a company’s performance metrics by the amount of equity it has raised in order to compare it to its bootstrapped peers, or itself on a bootstrapped-adjusted basis.

The “Rule of 40” is a benchmark proposed by a private equity investor who stated he would only invest in companies for which growth rate plus profitability margin was greater than 40. This rule of thumb is a great shorthand way to determine a company’s performance against its peer group.

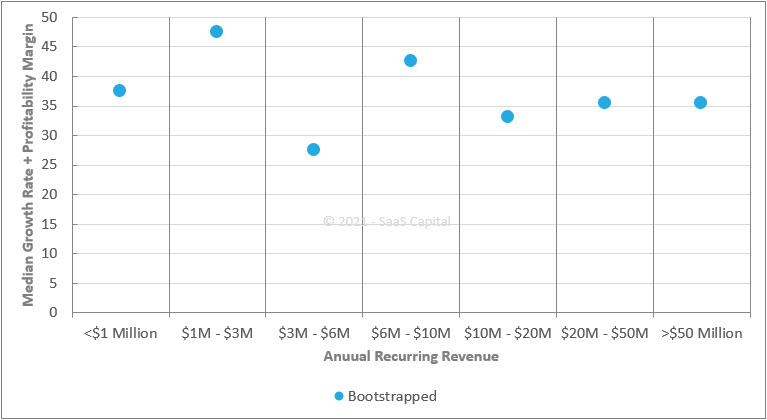

While growth plus profitability (GPP) of at least 40 is one investor’s benchmark for an investable company, the actual peer benchmarks are generally lower, which makes sense since an investor is presumably looking for better-than-average companies. The chart below shows the median GPP of bootstrapped companies from the survey, categorized by ARR ranges.

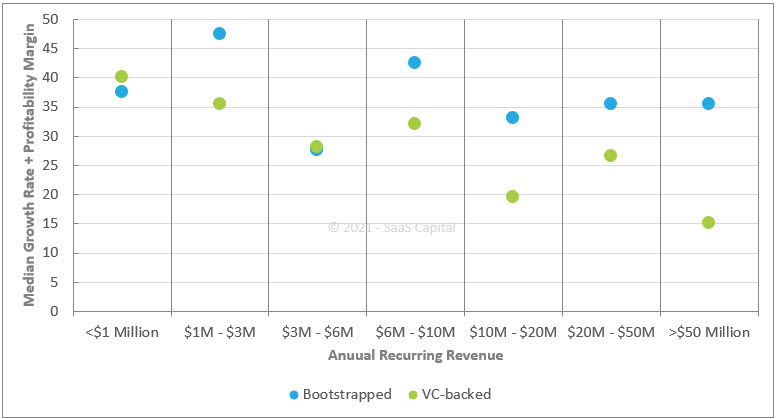

Before we even get to the adjustment, we were surprised to see that the median GPP of VC-backed companies is lower than its bootstrapped peers. The chart below compares the two groups.

Venture capital-backed companies are growing at a median rate of 43%, while bootstrapped companies are growing at a median annual rate of 26% . However, the burn rate differential of VC-backed companies, 15% of revenue versus +11% profitability for bootstrapped companies, far outweighs the growth rate differential, resulting in lower GPP medians before even adjusting for the capital raised (and spent) to get to this point. A last interesting point on the chart above is that bootstrapped companies tend to maintain a steady level of GPP as they grow, around 35%, while VC-backed companies’ GPP declines as ARR increases. Both types of companies are combating the same daunting math of growth rates, but it appears bootstrapped companies respond by increasing profitability, while VC-backed companies maintain or increase their spending.

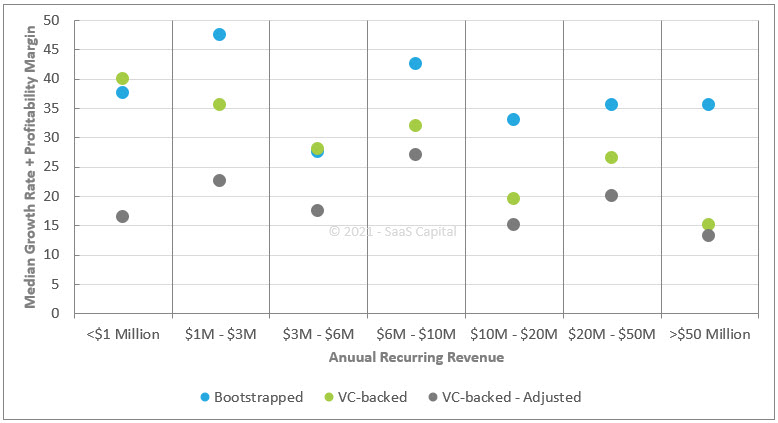

To adjust the GPP of venture-backed companies to an “as-bootstrapped” basis, we weight (divide) the GPP by the multiples of ARR that the company has raised. There is no adjustment for companies who have raised less than 1 times ARR, and we netted out current cash on-hand, to account for companies that may have just raised an equity round and have not yet deployed the capital into growth initiatives.

Since we use the multiple of ARR raised, the resulting downward adjustments deltas – the difference between the green dots and gray dots in the chart below for each revenue category. This is to say, somewhat obviously, the more capital the company has raised relative to its ARR, the more the GPP is adjusted. Early-stage companies raise more as a multiple of ARR than later-stage companies, so they are adjusted more.

The end result is fascinating: On an as-bootstrapped adjusted basis, the adjusted GPP of VC-backed companies is fairly consistent through the company life cycle, but instead of around 35%, VC-backed companies have adjusted-GPP levels of between 15 and 20%, about half of their unfunded peers.

This shows that the added spending from outside investment does not result in a growth rate increase to even reach parity with unfunded companies on a GPP basis, let alone surpass them. And when adjusting the GPP for how much capital was raised and spent, this contrast is even more significant.

One important caveat to this analysis is that it focuses solely on the GPP score, which puts equal weight on growth and profitability. PE investors may weight those two metrics equally, but VC investors typically weight growth over profitability, particularly early in a company’s life. But as stated above, the GPP is a good shorthand metric for company health, so it is a good starting place.

For more research around capital formation and the capital efficiency of SaaS companies, please see – Private SaaS Company Funding, Runway, and Capital Efficiency Benchmarking

*In the first quarter of each year, SaaS Capital conducts a survey of B2B SaaS company metrics. This year’s study marked our 9th annual survey, and, with over 1,400 private B2B SaaS companies responding this year, it is the largest survey of its kind and continues to grow every year. This year, for the first time, we asked several questions on funding sources and amounts and cash balances to study capital efficiency and runway among private SaaS companies.

It also needs to be explicitly stated that this data was collected in early 2020 and is based on 2019 performance metrics and data, before the impact of the COVID-19 pandemic. Benchmarking comparisons should be made to the same time period for your company.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe