Private SaaS Company Valuations: Q2 2020 Update

July 22, 2020

Public SaaS company data is the best starting point when valuing a private SaaS business so we created the SaaS Capital Index (SCI) to be an up-to-date valuation tool for pure-play, B2B, SaaS businesses. The SCI excludes companies with very low annual contract values (ACV) as these companies have characteristics more similar to B2C companies than B2B, and is based on annualized current run-rate revenue (ARR), not trailing or projected revenue like other indices use. For background on the SCI, please see our Q1 update and our valuation framework for private SaaS companies.

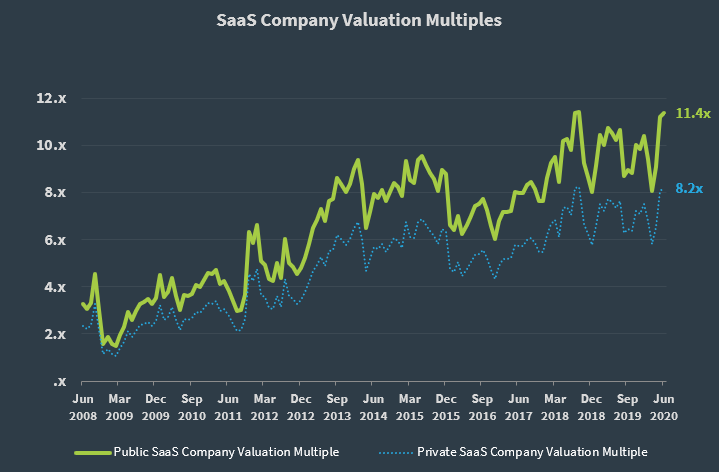

SaaS Company Valuation Multiples

As of June 30, the median SaaS valuation multiple for public companies stands at 11.4x ARR. Applying the historical private company discount of 28%, the median valuation multiple for private SaaS companies is currently 8.2x ARR. The chart below shows the long-term trend.

Valuations in the public markets are at all-time highs. The SCI is now tied for the highest value in our dataset’s history, which was hit in the fall of 2018.

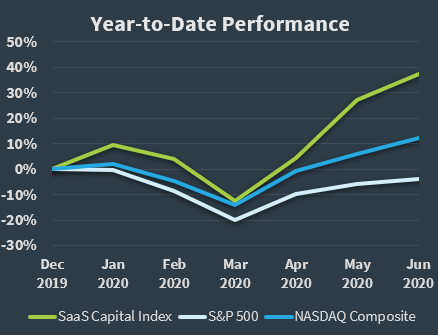

Year-to-Date SaaS Capital Index Performance vs. the Broad Market

After showing a drop of 12% at the end of the first quarter, the SCI rebounded sharply to now show a year-to-date gain of 37%.

At the end of the first quarter, the SCI showed a drop of 12% which was marginally better than the loss shown by the NASDAQ Composite. The stocks in the SCI have rallied sharply from their March lows, pushing the SCI to a year-to-date gain of 37%. This compares to a 12% gain for the NASDAQ Composite and a 4% loss for the S&P 500.

Of the stocks in the SCI, 79% are now positive on the year with 26% of the stocks showing a gain of more than 50%.

SaaS Companies with the Highest Multiples

The table below shows the 5 companies from the SCI with the highest ARR multiples.

| Company | Multiple | YTD Multiple Change | Monthly Revenue* | YTD Revenue Change | Stock Price | YTD Stock Price Change |

| Zoom Video Communications, Inc. | 53.4x | 92.8% | $109.39M | 97.0% | $253.54 | 273% |

| DataDog | 47.7x | 71.4% | $43.75M | 36.9% | $86.95 | 130% |

| Coupa Software Incorporated | 38.4x | 62.3% | $39.74M | 17.1% | $277.04 | 89% |

| Okta, Inc. | 34.x | 43.4% | $60.95M | 19.5% | $200.23 | 74% |

| Fastly, Inc. | 32.x | 234.8% | $20.97M | 26.4% | $85.19 | 324% |

*Quarterly revenue spread across each month, expressed in millions

Zoom Video Communications (ZM), a provider of video-first communication platform and web conferencing services, tops the list with a multiple of 53.4x ARR. Revenue growth is up nearly 100% this year while the stock is up more than 270% since the end of last year, forcing its multiple to nearly double so far this year.

DataDog (DDOG), which provides a monitoring and analytics platform for developers, information technology (IT) operations teams and business users, follows closely behind with a multiple of nearly 48x ARR. The company’s multiple has soared more than 70% so far this year as the stock has more than doubled and revenue has increased 37%.

Coupa Software (COUP), a provider of Business Spend Management solutions, has seen its multiple jump 62% while the multiple for Okta (OKTA), an independent provider of identity management solutions, has risen more than 40%.

Fastly (FLSY), a real-time content delivery network (CDN), rounds out the bottom of the top 5 but earns the distinction of having the largest year-to-date stock price gain, which in turn has sent the company’s multiple rocketing up more than 230%.

SaaS Companies with the Lowest Multiples

The table below shows the 5 companies from the SCI with the lowest ARR multiples.

| Company | Multiple | YTD Multiple Change | Monthly Revenue* | YTD Revenue Change | Stock Price | YTD Stock Price Change |

| FireEye Inc | 3.x | -25.0% | $74.91M | -0.5% | $12.18 | -26% |

| Upland Software Inc | 3.1x | -25.8% | $22.68M | 23.5% | $34.76 | -3% |

| LogMein, Inc. | 3.2x | -2.1% | $107.46M | 1.7% | $84.77 | -1% |

| Talend SA ADR | 4.x | -20.3% | $22.71M | 8.8% | $34.66 | -11% |

| Cornerstone OnDemand, Inc. | 4.1x | -33.7% | $50.05M | 3.6% | $38.56 | -34% |

*Quarterly revenue spread across each month, expressed in millions

As noted above, the majority of stocks in the SCI are showing a year-to-date gain but none of the 5 with the lowest multiples are positive. LogMeIn (LOGM) is nearly flat but that is due to its looming acquisition by Francisco Partners and Evergreen Coast Capital.

FireEye, Inc. (FEYE) provides intelligence-based cybersecurity solutions that allow organizations to prepare for, prevent, respond to and remediate cyber-attacks. The company commands the lowest multiple in the SCI at just 3x ARR. Year-to-date revenue has been flat as the stock has slumped.

Upland Software Inc. (UPLD) is a provider of cloud-based enterprise work management software applications for the information technology, process excellence, finance, professional services and marketing functions within organizations. Revenue is up 23.5% this year but shares are flat.

Talend SA (TLND) is a provider of open source integration solutions for data-oriented companies and integration platforms under Apache Spark. Year-to-date, an 8.8% gain in revenue combined with an 11% stock decline leaves the company with a 20% drop in its multiple.

Cornerstone OnDemand, Inc. (CSOD) provides learning and human capital management software, delivered as Software-as-a-Service (SaaS). The company earns the distinction of both the largest stock drop and the largest multiple decline.

Q2 SaaS Sector Observations

Earlier this month, Rob Belcher provided an update to the SaaS Capital community (you can join the community here) that included the following observations:

- All of the companies that we have spoken to that applied for PPP funding received it. Despite the program’s shortcomings, it was an effective tool to assist companies in making payroll and retaining employees.

- Based on conversations with companies in our portfolio and prospects, SaaS companies have seamlessly adjusted to WFH. After an initial dip in activities and bookings, beginning with the end of Q2 and continuing into Q3, outlooks are less impaired than originally thought.

- Further, on the new sales front, it appears that buyers of SaaS products have adjusted to remote work as well. Several companies reported opportunities that were in the pipeline pre-COVID slowing down, stalling or dying altogether, while opportunities that have entered the pipeline since the lockdowns are progressing like normal or even faster.

Resources mentioned in this post:

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe